Sigh…Do with the actual math what you will.

The simple version…

Yd = W . Ls-T wherein Yd is the disposable income of households, W is wage, Ls is Labor supply, and T is tax payments.

This equation requires two behavioral equations.

The first is the T (tax) function defined by the government

T = t . W . Ls, T < 1 wherein t is the tax rate of a proportional wage tax leading us to the second equation…

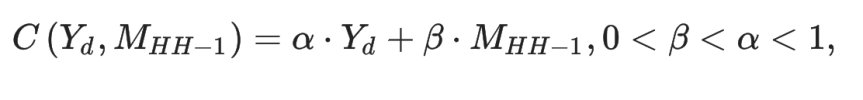

View attachment 39894

where “a” and “B” are coefficients and Mhhh is money stock of households from the previous period. The consumption function in equation 3 depends on the disposable income, with α as the marginal propensity to consume and

β as the influence of the money stock households hold from previous periods. (I had to cut and paste the last one and the next, I can’t type in “maths”).

So, to get to what

@Spekkio wrote (accurately and simply) money is created by the government via the public budget deficit…

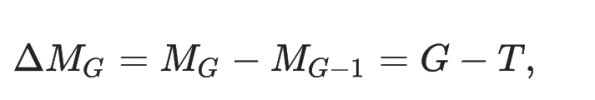

View attachment 39895

wherein Mg-1 is money creation of the government in the current (previous) period and

G is government expenditures for goods and services. Equation 4 can be understood as the monetization of debt. Instead of I-owe-you’s (IOUs), the government buys goods and services by creating its own money, also called outside money. Money is defined here as an accounting measure, or “as a two-sided balance sheet phenomenon.” Therefore, it cannot be said whether it is an asset or only a numeraire - meaning the stuff in your wallet is just a confidence trick so you know you have a place on the balance sheet.

Got it?